From Grey to Green The Journey Towards Decarbonizing India’s Cement Industry

As India advances toward its net-zero goals, the cement industry is emerging as a global model for green transition, driven by bold policy alignment, carbon reduction targets, and innovations in alternative fuels, sustainable materials, and carbon capture technologies. Dr L P Singh, Director General National Council for Cement and Building Materials (NCCBM), India, traces the industry's progress, breakthroughs, and the roadmap ahead for building a climate-resilient future.

Introduction

Our Hon’ble Prime Minister of India made a commitment to make India Net Zero at the 26th session of the Conference of the Parties (COP26) held in Glasgow in November 2021. India has also updated its Nationally Determined Contribution (NDC) submitted to the United Nations Framework Convention on Climate Change (UNFCCC). India presented to the world five nectar elements (Panchamrit) of India’s climate action. The new climate action targets “Panchamrit” by India included:

- A Net Zero target for India by the year 2070

- Achieving carbon intensity reduction of 45% over 2005 levels by 2030

- Reducing 1 billion tonnes of projected emissions till 2030

- Installing non-fossil fuel electricity capacity of 500 GW by 2030

- Sourcing 50% of energy requirement from renewables by 2030

To achieve the target of Net Zero, all core sectors like power, steel, and cement are making concerted efforts to reduce the carbon footprint related with their activities. Amongst the eight core industries of India, the cement industry plays a vital role in the growth and economic development of India because of its strong linkage to other sectors such as infrastructure, construction, housing, transportation, coal and power, etc.

The Indian cement industry has also been a strong contributor to employment, fiscal revenue, and community development, while achieving manufacturing and technological advancements. Approximately, 65% of cement demand comes from housing and real-estate sector with schemes like “Housing for All” by 2022; 20% comes from infrastructure development; and the remaining 15% demand is related to industrial development.

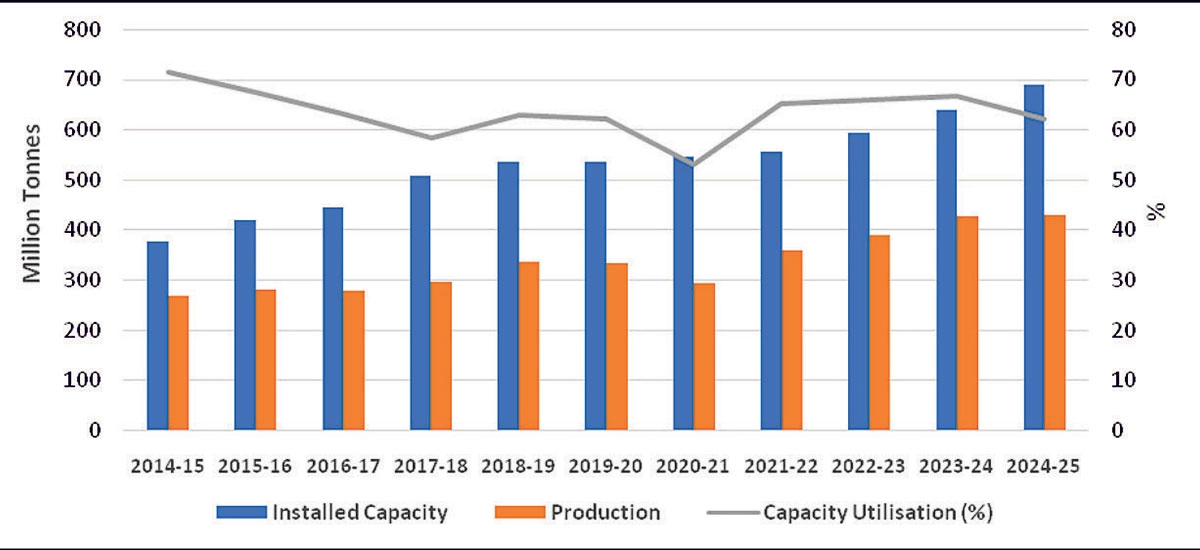

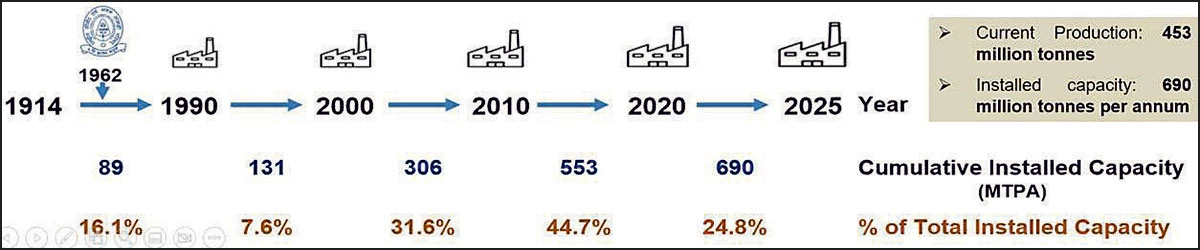

India is the second largest manufacturer of cement in the world. The cement industry comprises about 161 large integrated cement plants, about 130 grinding units, 05 clinkerization units and more than 62 mini cement plants. The installed capacity of cement in India is about 690 million tonnes and production of cement during the year 2024-25 is 453 million tonnes (MT).

Figure 1: Growth of Indian Cement Industry

Figure 1: Growth of Indian Cement Industry

The industry plays a crucial role in the development of the housing and infrastructure sector. The price and distribution control of cement was removed in 1989 and the cement industry was de-licensed in 1991. Since then, the Cement Industry has progressed well - both in capacity/production and as well as in process technology. Cement consumption in India is around 290 kg per capita against a global average of 540 kg per capita, which shows significant potential for the growth of the industry.

Cement is one of the most technologically advanced industries in the country. Our modern cement plants are comparable to the best in the world. The Industry has managed to keep pace with the global technological advancement. The induction of advanced technology has helped the industry to improve its efficiency by conserving energy, fuel, and addressing environmental concerns.

Figure 2: Modern cement plants in India

Figure 2: Modern cement plants in India

The Indian Cement Industry is relatively modern compared to its global counterparts. Around 44.0% of the total installed cement capacity has been set up over the last decade and stands at par with the best in the world.

Status of CO2 emissions in cement industry

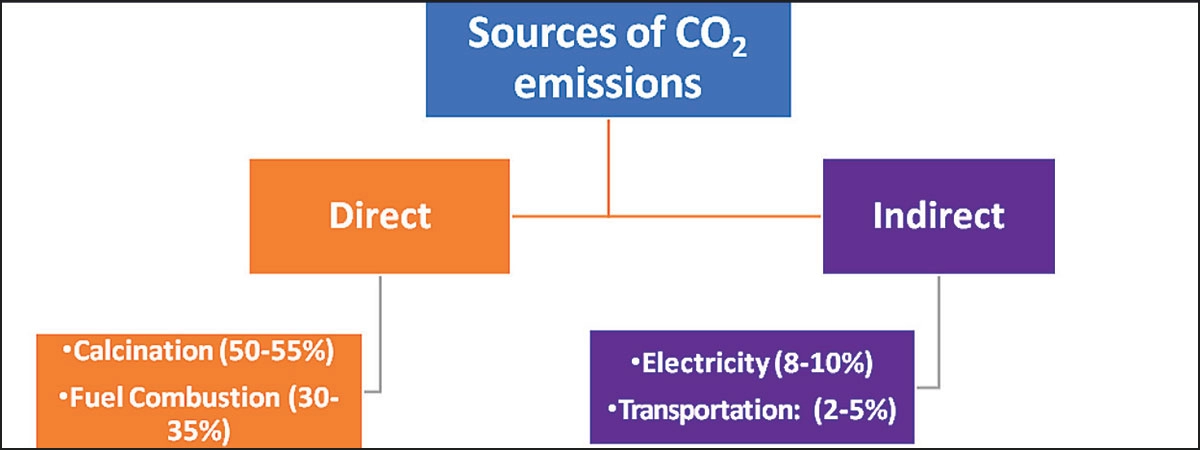

Globally, the cement sector generates about 7% of the total anthropogenic CO2 emissions. In hard-to-abate sectors like cement, it is technologically very difficult to reduce the process related CO2 emissions, the sources of which are categorized as direct sources and include Calcination (55-60%), Combustion (25-30%), indirect sources including Electricity (8-10%), and transportation (2-5%).

Figure 3: Sources of CO2 emissions in cement plants

Figure 3: Sources of CO2 emissions in cement plants

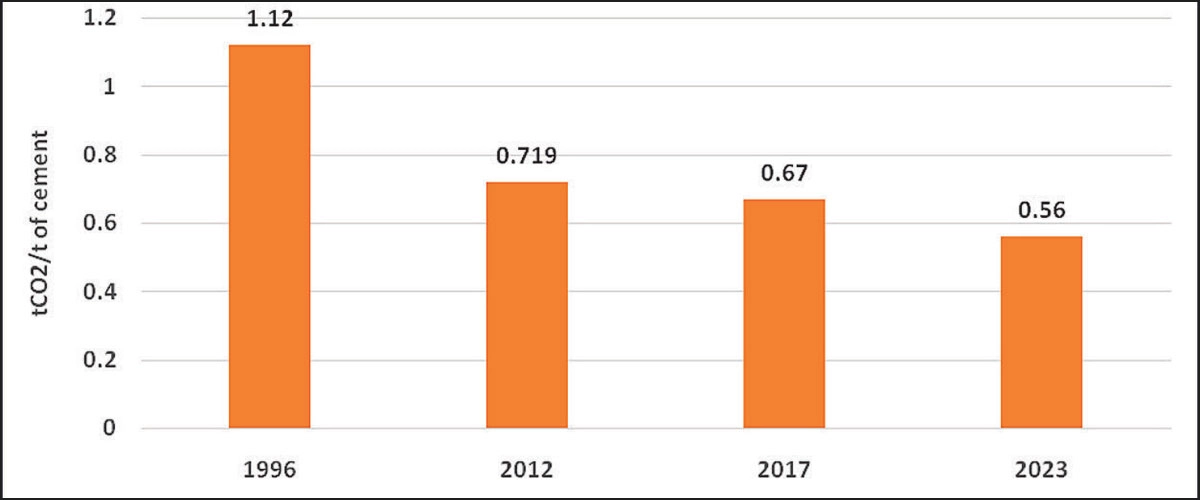

The industry has been working on the issue of its Green House Gas (GHG) emissions and has brought down the CO2 emission factor from 1.12 tonnes CO2/tonne of cement in 1996 to about 0.560 tonnes CO2/tonne of cement in 2023 (as shown in Fig 4). CO2 emissions are targeted to be further reduced to about 0.35 tonnes CO2/tonnes of cement by 2050, as estimated in the cement industry’s low carbon technology roadmap. (source: WBCSD, 2018).

Figure 4: Reduction in specific CO2 emissions of cement industry

Figure 4: Reduction in specific CO2 emissions of cement industry

The Indian Cement Industry has taken several steps like the Science- Based Targets Initiative (SBTi). Many cement companies have verified their net zero CO2 reduction targets by SBTi in line with a 1.5°C future. Several cement companies have joined Climate Group’s EP 100 initiative to achieve the goal of doubling energy productivity; RE 100 initiatives to meet 100% of its electricity requirement by Renewable Energy to mitigate greenhouse gas emissions; and the EV 100 initiative to switch their fleet to Electric Vehicles, and/or install charging for staff and/or customers by 2030; and Internal Carbon Pricing - systematically following the low carbon technology roadmap.

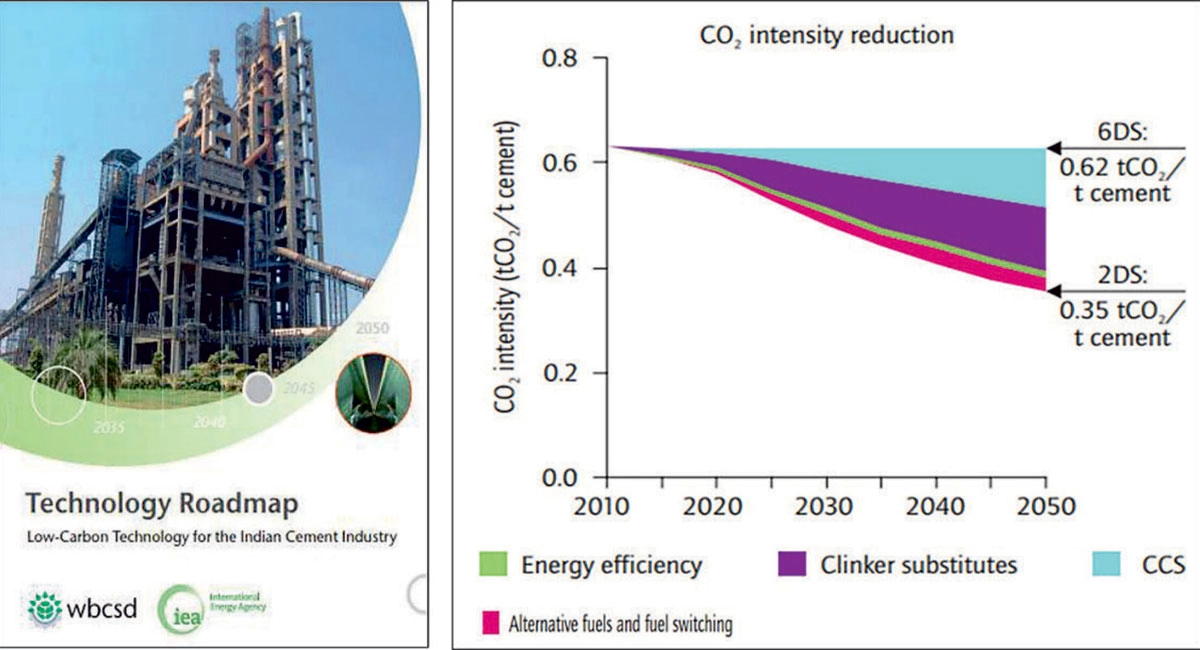

Figure 5: Low Carbon Technology Roadmap

Figure 5: Low Carbon Technology Roadmap

The cement industry also plays a key role in the circular economy framework of our country by utilizing wastes/by-products of various industries like fly ash and FGD gypsum from thermal power plants, slag from steel plants, phosphogypsum from the fertilizer industry, red mud from the aluminium industry, hazardous waste, surplus biomass, plastic waste, refuse derived fuel (from MSW), etc. as alternative fuel, marble sludge, paper sludge, jarosite, and other waste as alternative raw materials.

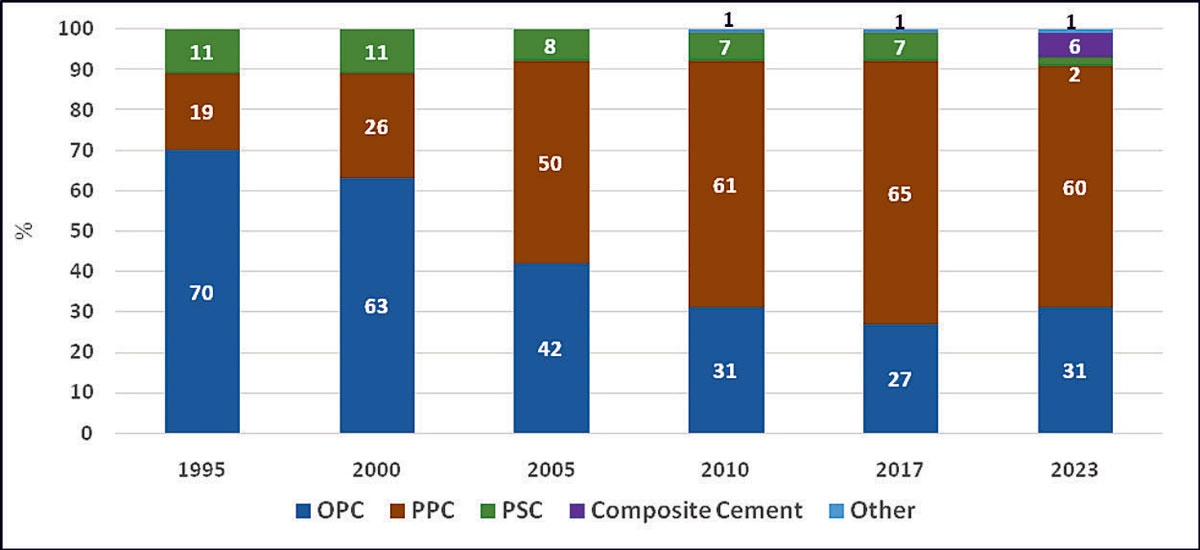

Figure 6: Cement Mix in India

Figure 6: Cement Mix in India

Low carbon technology roadmap for Indian Cement Industry

The journey towards decarbonization of the Indian cement industry started in 2012 with the preparation of a Low Carbon Technology Roadmap, prepared by the International Energy Agency (IEA) and Cement Sustainability Initiative (CSI), in collaboration with the Confederation of Indian Industry (CII) and the National Council for Cement and Building Materials (NCCBM).

The identified levers for decarbonization of Indian cement industry are:

- Substitution of Clinker

- Alternative Fuel and Raw Materials

- Improving Energy Efficiency

- Installation of Waste Heat Recovery Systems (WHRS)

- Carbon Capture and Storage/Utilization

- Newer technologies like Renewable Energy, Novel Cements etc.

Substitution of clinker by production of blended cements

The first lever identified for decarbonization is substitution of clinker by production of Blended Cements like fly ash-based Portland Pozzolana Cement (PPC) and slag-based Portland Slag Cement (PSC). The maximum replacement of clinker allowed is 35% by fly ash in PPC and 70% by granulated slag in PSC. Presently, the blended cements constitutes about 68% of the total cement produced in India (Fig 6).

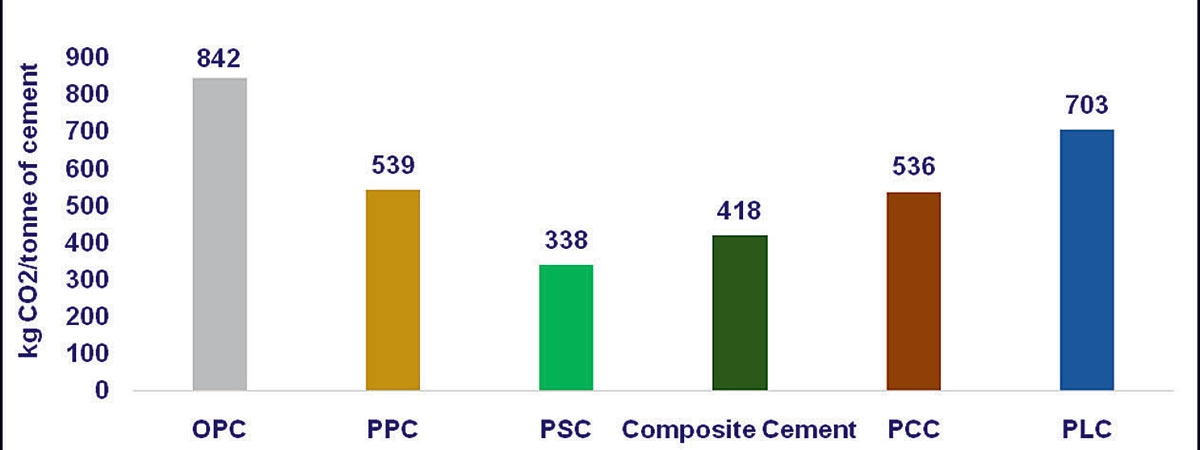

Figure 7: Specific CO2 emissions of various types of cement (Typical values)

Figure 7: Specific CO2 emissions of various types of cement (Typical values)

For production of one tonne of fly ash-based PPC, the specific CO2 emissions are around 539 kg CO2 per tonne of PPC, which are 36% lower as compared to CO2 emissions from OPC production. Similarly, for production of one tonne of slag-based PSC, the specific CO2 emissions are around 338 kg CO2 per tonne of PSC, which are 60% lower as compared to CO2 emissions from OPC production (Fig 7).

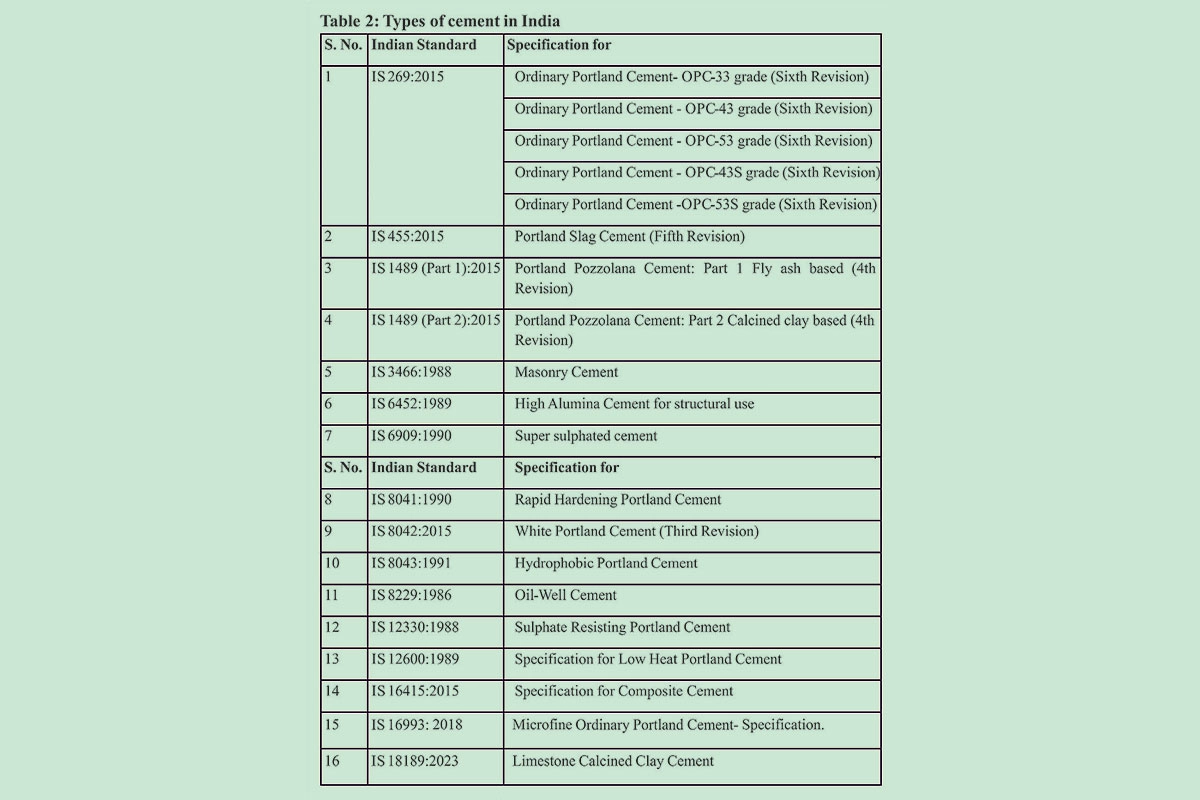

India is producing different varieties of cement like Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC), Composite Cement, Oil Well Cement, White Cement, etc. These different varieties of cement are produced as per the Bureau of Indian Standard (BIS) specifications and the quality is comparable with the best in the world.

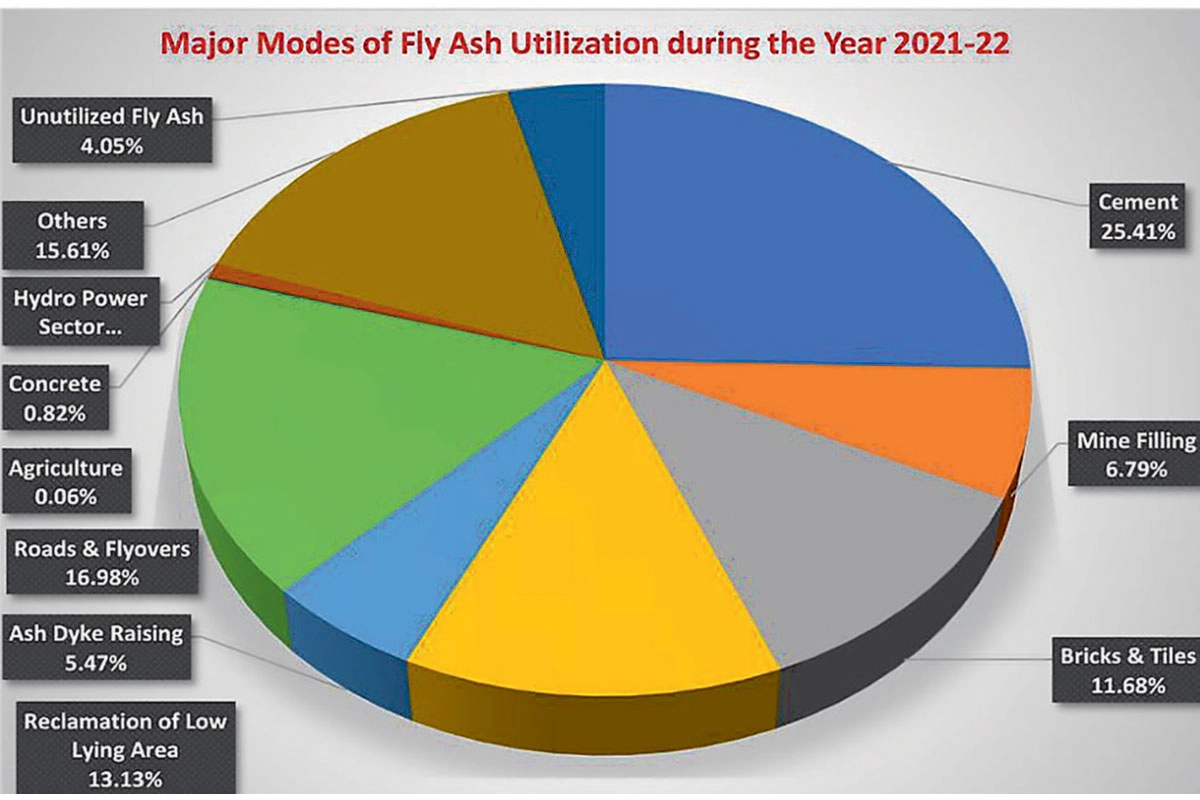

The Indian cement industry utilizes 25.41% i.e. 68.6 million tonnes out of the total fly ash generation of 270 million tonnes from thermal power plants in India for production of fly ash-based PPC (Fig 8). In addition, there are legacy stocks of 1700 million tonnes of fly ash lying at various thermal power plants. NCCBM has undertaken research projects to utilize the coarser fly ash in cement manufacturing.

The Indian Cement Industry uses more than 90% of 24 million tonnes of granulated slag generated for production of slag-based PSC. Although PSC is one of the greenest cements, its production is lower due to non-availability of slag.

Considering the future availability of fly ash in India, new low carbon cements are being developed. These are at various stages of standardization by BIS for Clinker Substitution to minimize the carbon footprint of the Cement Industry. Some of the new low carbon cements developed and being standardized by BIS are:

- Portland Composite Cement based on fly ash and limestone

- Portland Limestone Cement

- Portland Dolomite Cement

- Multi component blended cement

- Geopolymers

Usage of alternative fuels and raw materials

Alternative Fuels

The Cement industry is an energy intensive industry, primarily depending on conventional fuels like coal and pet coke. The industry has been able to substitute 7% of conventional fuels on a thermal basis as compared to 1% in 2010, using alternate fuels like Refuse Derived fuels, agro waste/biomass, hazardous wastes like paint sludge, Textile Effluent Treatment Plant (ETP) Sludge, Tannery ETP Sludge, process waste, waste residue, chemical sludge, process sludge, phosphate sludge, insulation waste, mixed salt, organic residue, liquid organic residue, spent solvent, benzofuran, waste lubricant oil etc. Some cement plants have been reported to achieve Thermal Substitution Rate (TSR) of as high as 35%.

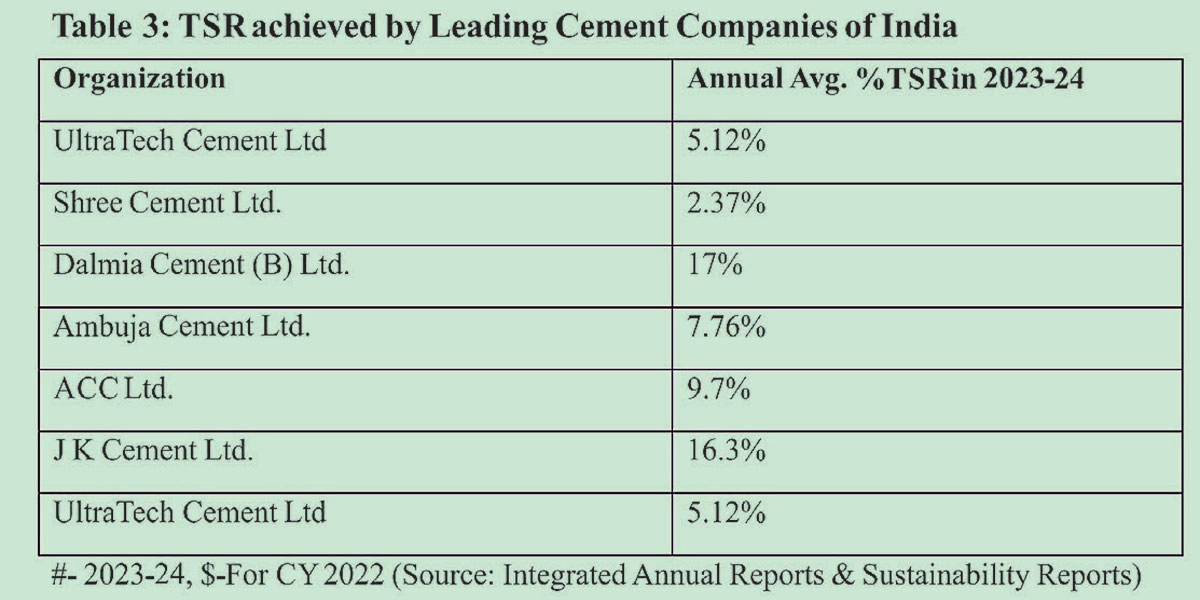

The leading cement companies in India have achieved TSR in the range of 4 - 17% on an average annually (Table 3), while some have achieved a high 25 - 35%.

Figure 8: Utilization of fly ash in various sectors

Figure 8: Utilization of fly ash in various sectors

Alternate Raw Materials

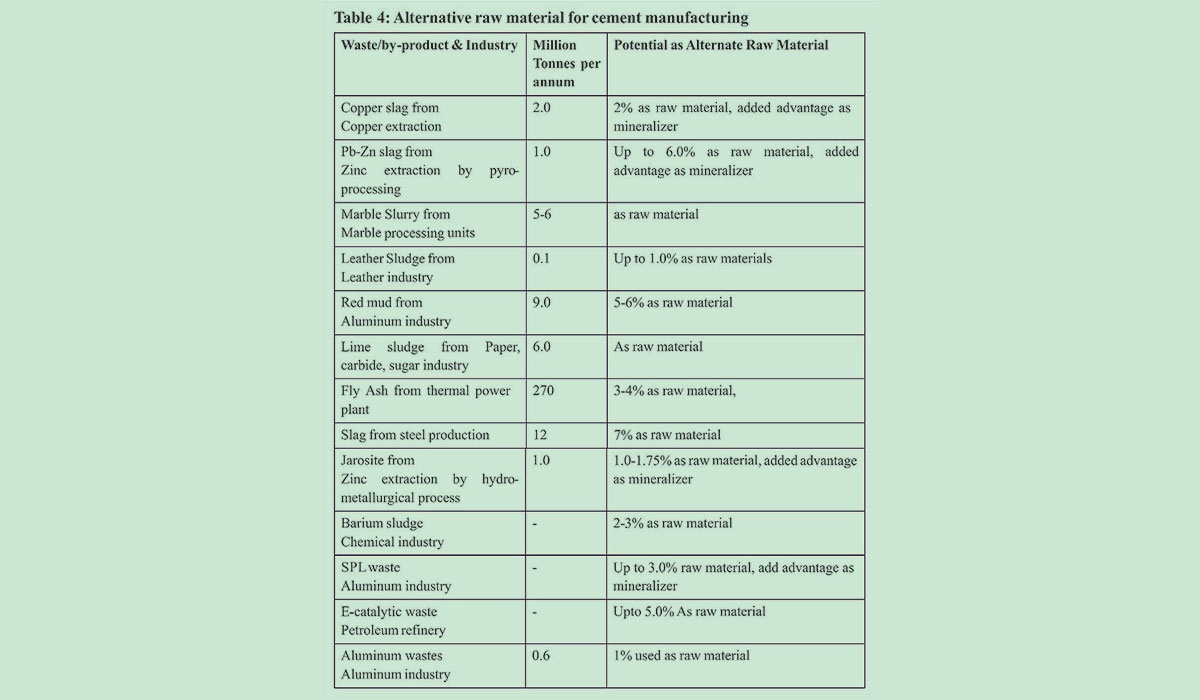

The Indian cement industry is at the centre of a circular economy framework. Waste and by-products from other industries can be used as alternate raw materials as a replacement of natural raw materials like limestone for clinker production (Table 4).

During cement production, limestone breaks up to produce lime (CaO) and CO2 on heating. The CO2 emissions from limestone contribute 55% of the total CO2 emissions from cement manufacturing. Replacement of limestone will help in reducing the carbon emissions.

Improvement in energy efficiency

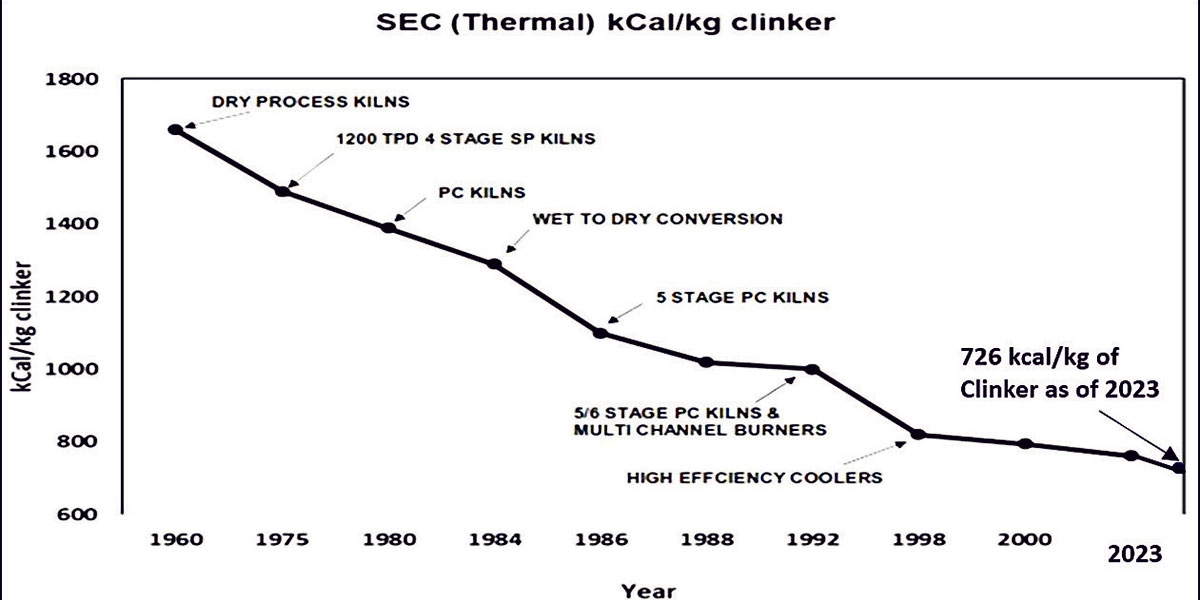

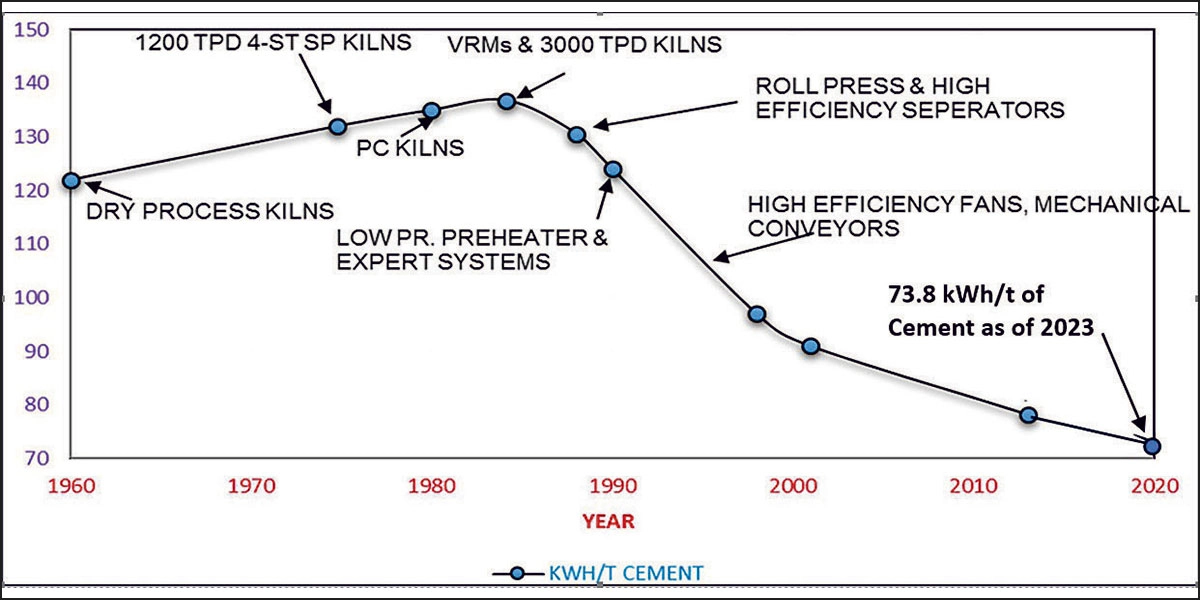

The Indian cement industry’s estimated average specific thermal and electrical energy consumption is 740 kcal/kg clinker and 73.8 kWh/t cement, respectively. Currently, the best specific thermal and electrical energy consumption by the Indian cement industry for FY 2023- 24 is 671 kcal/kg clinker and 56.42kWh/t cement.

The average specific thermal energy consumption for dry process cement plants was more than 1660 kcal/kg clinker in 1960, and due to advancement in technology it is now around 726 kcal/kg clinker. The present and past trend of average specific thermal energy consumption is shown in Fig 9, which also indicates timelines of major technology interventions:

The average specific electrical energy consumption was around 122 kWh/tonne of cement in 1960 but it went up to 136 kWh/tonne of cement in 1984 due to setting up of large cement plants (i.e. more than 3000 tpd capacity). The specific energy consumption started decreasing in late 80’s due to technology change in large cement plants. The present and past trend of average specific electrical energy consumption (Fig 10) also indicates timelines of major technology interventions:

Perform, Achieve and Trade (PAT) scheme

The Government of India announced the Perform, Achieve and Trade (PAT) Scheme of BEE, Ministry of Power. This innovative, market-based trading scheme for improvement in energy intensive industries in India, under the National Mission for Enhanced Energy Efficiency (NMEEE) in 2008, aims to improve energy efficiency in industries by trading in energy-efficiency certificates in energy-intensive sectors.

The PAT Scheme is a regulatory instrument to reduce the specific energy consumption in energy intensive industries. As per PAT rules, when a designated consumer overachieves the notified SEC targets in the compliance year, EScerts are to be issued by the Central Government for the difference of quantity between notified target and achieved SEC.

The cement plants in PAT Cycle1 surpassed the energy saving targets and achieved savings of 1.48 MTOE, which is around 81% higher than the savings target. Similarly, the plants in PAT Cycle 2 surpassed the energy saving targets and achieved savings of 1.56 MTOE, which is around 48% higher than the savings target.

Figure 9: Trend of Thermal Energy Consumption in the Indian Cement Industry

Figure 9: Trend of Thermal Energy Consumption in the Indian Cement Industry

Carbon Credit Trading Scheme (CCTS)

The Bureau of Energy Efficiency (BEE), Ministry of Power, is in the process of setting up of Indian Carbon Market (ICM), under which, the existing PAT Scheme will be incorporated in the new Carbon Credit Trading Scheme (CCTS) of ICM. Under this scheme, targets will be set for individual plants in terms of carbon intensity instead of absolute CO2 emissions, that is, plants will have to reduce their specific CO2 emissions (tCO2 eq.) per tonne of cement. These targets will be set by MoEF&CC, considering sectoral benchmarks.

Figure 10: Trend of Electrical Energy Consumption in Indian Cement Industry

Figure 10: Trend of Electrical Energy Consumption in Indian Cement Industry

Waste heat recovery system

Indian cement plants’ adoption of Waste Heat Recovery Systems (WHRS) has offered numerous benefits, such as mitigating Green House Gas (GHG) emissions and achieving PAT cycle targets. WHRS capacity in India increased by 212% in 2017 compared to 2010, with a total installed capacity of 344 MW in 2017. In 2025, the capacity has gone up to about 1239 MW.

CO2 Capture and Utilization in Cement and Construction Sector

One of the important challenges for decarbonization of cement industries worldwide is to reduce the process emissions rising out of calcination of limestone. To achieve the target of Net Zero in a hard-to-abate sector like cement, implementation of Carbon Capture and Utilization is required. The important aspect of CCU is to store or utilize the captured CO2, thereby not letting CO2 enter the atmosphere for mitigation of global warming.

Figure 11: Carbon capture process

Figure 11: Carbon capture process

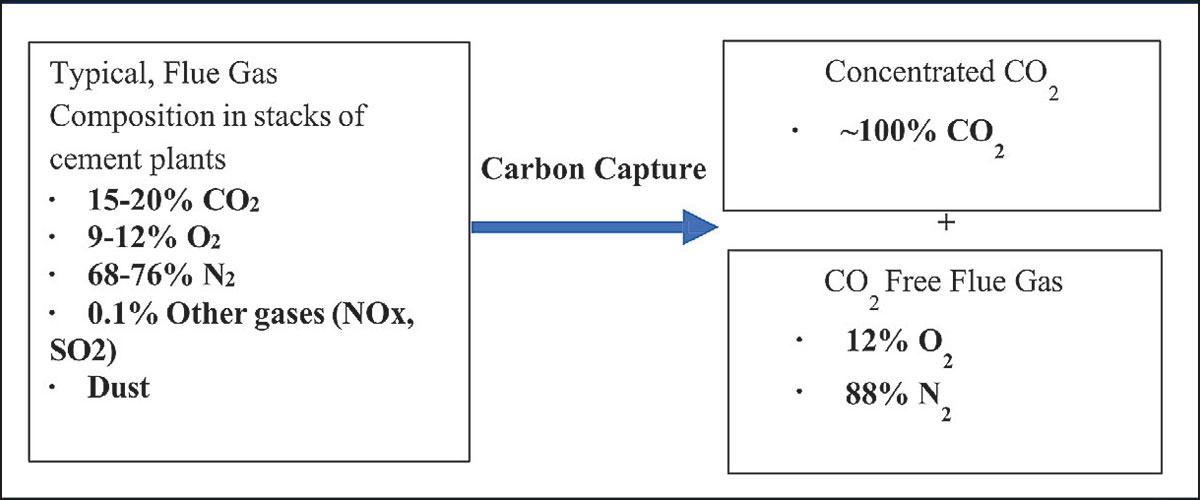

Carbon Capture

The first stage of CCU is CO2 capture is separating CO2 from the flue gases coming out of the stacks of cement kilns. A typical composition of flue gas from stacks of cement plants contains 15-20% CO2, 10% O2, 71.9% N2 and0.1% other gases. In the carbon capture process, the CO2 is separated as concentrated CO2 for storage and transportation and the remaining CO2 free flue gases are emitted in the atmosphere (Fig 11).

Figure 12: CO2 utilization pathways

Figure 12: CO2 utilization pathways

Carbon capture techniques for cement industry can be classified under four categories:

- Post-combustion processes

- Pre-combustion process

- Oxy-fuel combustion process

- Electrification of pyro-process

Post-combustion carbon capture process involves extracting CO2 from the flue gas after combustion of fossil fuels. Out of the four capture techniques, post-combustion is well established and commercially available. The advantage of this technique is that it does not interfere with the plant process. The various methods of post-combustion carbon capture are:

- Chemical absorption: Monoethanolamine (MEA)

- Calcium looping

- Chilled ammonia process

- Solvent Based absorption

CO2 Utilization

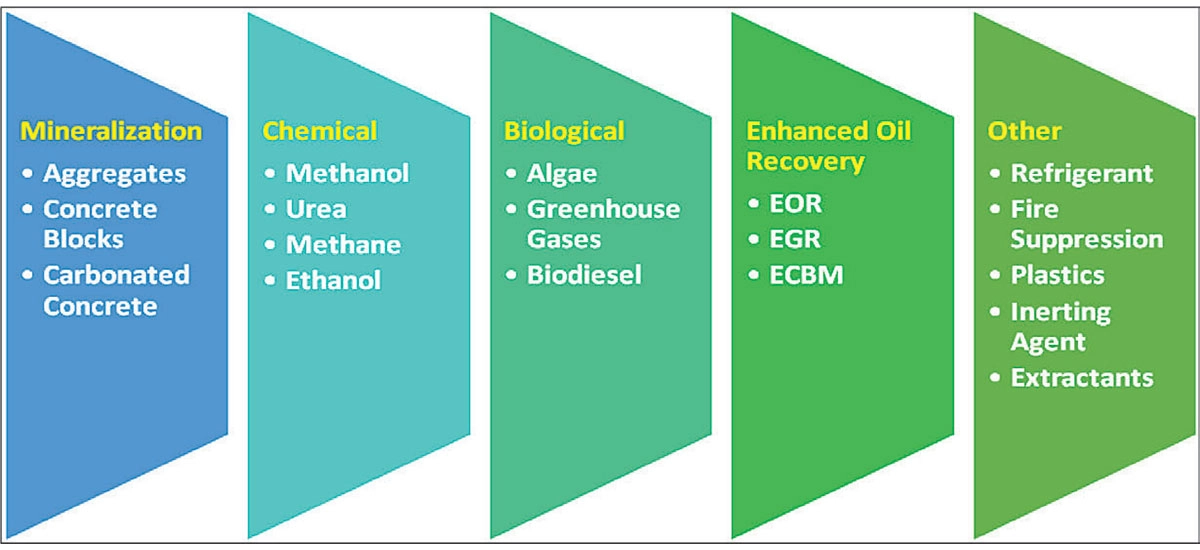

After capturing, the CO2 is transported to the utilization/storage site. Dalmia Cement (Bharat) Ltd. in association with Asian Development Bank has carried out a pre-feasibility study to assess the techno-economic pre-feasibility of the CCUS options in its Ariyalur cement plant. There are several utilization pathways of captured CO2 identified in the report like mineralization, production of chemicals like urea, methanol, methane etc., and refrigerant as inerting agent, for fire suppression, enhanced fuel recovery, in production of plastics, for biological conversion to algae, for use in food products like beverages etc. (Fig 12).

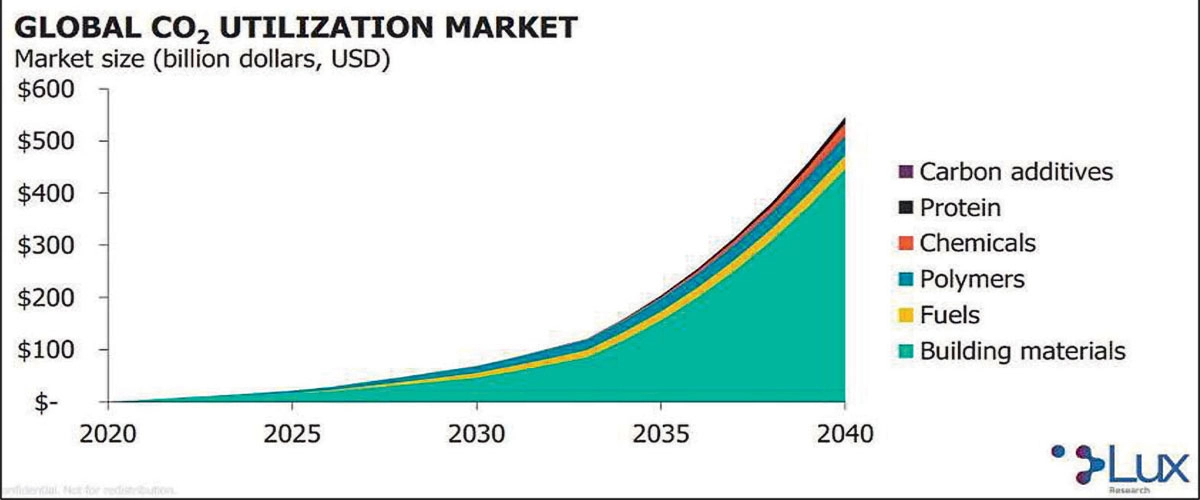

The utilization of CO2 in construction materials is considered as one of the most promising routes for carbon sequestration, with a $400 billion market opportunity (Fig 13) and a potential to reduce annual CO2 emissions by up to 3 Gt by 2030.

Figure 13: Global CO2 utilization market

Figure 13: Global CO2 utilization market

Way Forward

To further decarbonize the cement manufacturing process, following actions are being undertaken:

- Implementation of Carbon Credit Trading Scheme (CCTS)

- Creation of CCUS Mission

- Defining Low Carbon Cements

- Guidelines for Green Procurement

- R&D on Low Carbon Cements and new SCMs

- R&D on CO2 utilization especially mineralization aspects

References

- Cement Information System (CIS) Portal, DPIIT, Govt. of India

- The Cement Industry-India 2024. NCB Compendium, 2018 & 2024

- Cement Manufacturers’ Association, India

- Review of Low Carbon Technology Roadmap, WBCSD, 2018

- Low Carbon technology Roadmap for Indian Cement Industry, CSI-WBCSD, 2013

- Annual reports and Sustainability Reports of Cement Companies

- Global CO2 utilization market, Lux Research

- Prefeasibility Study on Carbon Capture and Utilization Cement Industry of India, ADB Technical Assistance Consultant’s Report, Oct 2021