CRISIL: Paint Sector Growth Slows in FY26

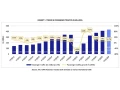

India’s paint sector is set for another sluggish year, with fiscal 2026 volume expected to rise just 4-5%, amid weak urban demand due to slowing housing activity—especially in the affordable segment—and tepid automotive sales. Revenue growth is expected to remain flat this fiscal, following a ~2% decline last fiscal, as downtrading, aggressive competition from a new entrant, and a major acquisition continue to pressure realizations. Operating margins were approximately 300 basis points (bps) lower last fiscal at around 16.5%, and are expected to dip another 100 bps to about 15.5% this fiscal as new manufacturers push for market share and incumbents spend heavily to defend their turf. Softer titanium dioxide and crude-linked input costs are likely to provide some relief, though.

With sufficient capacity already in place, capital expenditure (capex) will be directed toward product upgrades and backward integration, comfortably funded through healthy internal accruals. Along with strong balance sheets, this is likely to keep credit profiles healthy. Our analysis of the top five manufacturers, representing about 85% of the organised sector’s ~Rs 60,000 crore revenue, indicates as much.

Says Anuj Sethi, Senior Director, Crisil Ratings, “The first quarter of this fiscal saw sluggish growth and further erosion of pricing power amid intensifying competition. Last fiscal, volume rose 8-9%, but revenue fell as aggressive price cuts, rebates, and discounts erased volume gains. The trend is expected to continue this year, compounded by weak urban demand, downtrading in decorative paints, slowing housing activity, and tepid automotive sales hitting industrial paints. Volume growth is expected to halve to 4-5%, and with realizations under pressure, sector revenues will remain subdued.”

While urban demand (~65% of sector revenue) is expected to remain tepid, rural demand could offer some relief in the coming quarters, supported by a good monsoon, improving farm incomes, and festive repainting.

Says Poonam Upadhyay, Director, Crisil Ratings, “Competitive realignment will intensify as incumbents defend share, new entrants expand, and the recent acquisition by a significant manufacturer reshapes the market. This will keep pricing power weak and marketing spends elevated. As a result, operating margins are expected to dip 100 bps to ~15.5% despite some support from benign input costs. However, any sharp currency swings or global volatility affecting crude-linked derivatives could dent margins further, given limited ability to pass on costs in a highly competitive market.”

To limit profitability pressures, manufacturers are focusing on automation, supply-chain optimisation, backward integration of key inputs, and product innovation, leveraging existing capacity. With utilisation at ~70%, no major capex is planned in the near term. Capex by the top five manufacturers nearly halved to ~Rs 2,100 crore in fiscal 2025, even as new entrants commissioned six plants, spending ~Rs 10,000 crore in the past two years.

The sector’s financial resilience continues, with established players maintaining near debt-free balance sheets (gearing below 0.05 times as of March 2025) and robust liquidity of over Rs 5,500 crore.

Volatility in crude oil prices, currency movements, rural demand recovery, and any sharp rise in competitive intensity will bear watching in the road ahead.