India Ratings Expects Mid-to-High Single-Digit Growth in FY26 for EPC Sector

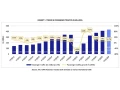

India Ratings and Research (Ind-Ra) has projected mid-to-high single-digit revenue growth with largely stable margins for engineering, procurement, and construction (EPC) companies in FY26, with some potential upside. This comes despite a weak base in FY25, when sector revenues fell 4%-5% YoY and EBITDA remained largely flat, weighed down by the election season.

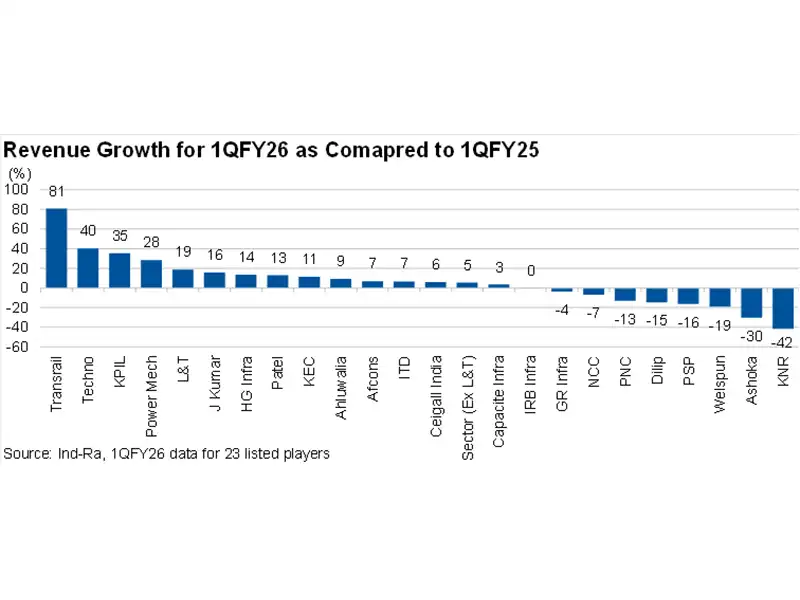

The EPC sector, across 22 listed entities, posted a 5% YoY revenue growth in 1QFY26, marking the fifth consecutive quarter of single-digit growth. EBITDA margins stood at 10.6%—30 bps lower YoY but slightly better than the 10.4%-10.5% range recorded in 2Q-4QFY25.

Segment-wise performance was mixed:

- Highways: Revenue growth of 11% YoY, but margins declined by 150 bps.

- T&D/Power: Revenue up 29% YoY, with a 90-bps margin expansion.

- Metros & Heavy Civil: Reported improved growth and margins.

- Buildings: Impacted by unseasonal rains in May and labour churn.

- Jal Jeevan Mission (JJM): Continued to underperform, with little sign of working capital release in 1QFY26.

“The hopes of strong start to FY26 by the EPC sector have not materialised, despite an undemanding base of the past year, hit by the election impact. Guidance by the companies suggests aggregate revenue growth of 12.7% yoy, around 100bp lower than the earlier guidance. This is susceptible to further downside as the companies’ guidance heavily relies on the hopes of a second-half recovery and assumption of robust order flows from the Ministry of Road Transport and Highway (MoRTH)/National Highway Authority of India (‘IND AAA’/Stable), after the recent announcement of a project-wise pipeline worth INR3.5 trillion, to be awarded in FY26. Margin recovery hopes have also receded with aggregate guidance suggesting a 20bp improvement at 10.8% in FY26 versus the past quarter’s assumption of 11%. Central and state capex is likely to grow faster in FY26 with a lean election season, yet the overall sentiment for fresh investments remains muted, given the uncertain policy environment,” says Krishan Binani, Director, Corporate Ratings, Ind-Ra

Order book grew 9% yoy in 1QFY26, faster than revenue growth, leading to slightly a better order book cover of 2.7x vs 2.5x yoy. The ordering activity was led by T&D/power, buildings & factories, and urban infrastructure segments such as metros. Credit metrics as reflected in interest coverage ratio was stable at 3.3x. Liquidity conditions are comfortable with the 100bp cut in policy rate and increased non-fund-based working capital limits availability with a gradual pick-up in surety bonds.

Sluggish Revenue Growth in 1QFY26: The EPC sector comprising 22 listed companies (excluding Larsen & Toubro Limited (L&T, ‘IND AAA’/Stable) witnessed 5% yoy revenue growth in 1QFY26. The quarter witnessed unseasonal rains in some parts of the country, labour shortages in specific segments such as buildings, and a volatile global policy environment. Tariff-linked uncertainties are likely to weigh on fresh private sector investments, even as spending support is expected from both central and state governments especially given the undemanding base of past year. Other factors which pose risks are unfavourable trade policies, extreme weather, labour shortage, state-specific spending priorities, and supply chain constraints.

The roads sector witnessed an 11% yoy decline in revenue in 1QFY26, fifth consecutive quarter of decline. This was driven by sluggish central government ordering, delayed commencement of state projects and generally challenging operating environment with heavy rains in few states, exacerbated by raw material challenges. The quarter saw several companies facing debarments from bidding, following heavy rain-linked incidents in Kerala. Moreover, the Ministry of Road Transport and Highways has reduced the construction target for FY26 to 10,000km, lowest since FY18. The ministry has taken several steps to address unhealthy competition by tightening the bidding criteria (higher net-worth requirements), coordinating closely with states for project selection, enhancing scrutiny of quality on detailed project reports, and establishing milestones for land acquisition and various clearances before bidding. All of these factors are likely to signal a turnaround in coming quarters.

The T&D/power sector was the strongest segment in 1QFY26, growing 29% yoy, aided by robust order books and continued resilient global activity amid a structural increase in power demand. Work has commenced on smart metering projects in Maharashtra and is likely to commence on Bharatnet projects from 3Q. JJM projects continue to struggle, despite the central government significantly increasing the budget to INR624.9 billion in FY26BE (FY25RE:INR209.7 billion) and the extension of the mission by three years. Most companies delayed execution due to low receivable recovery and remain cautious despite the increased budget allocations. This is due the conditions imposed for disbursements by the center and enhanced monitoring of fund usage. Elsewhere, state-specific water projects have started to witness increased execution/awarding activity, led by recovery in Andhra Pradesh and Telangana.

Revenue growth guidance by EPC companies points to 12.7% yoy revenue growth for FY26, down by 100bp qoq, driven by 18%-19% yoy revenue growth in T&D/power, 15%-16% yoy growth in urban infra such as metros, 11%-12% yoy growth in building & factories and a sluggish recovery of below 5% yoy growth in the roads sector. The companies who have reduced their revenue guidance includes Dilip Buildcon Ltd (Dilip, debt rated at ‘IND A’/Positive), HG Infra Engineering Ltd (HG infra), PNC Infratech Ltd (PNC) , KNR Constructions Ltd (KNR; debt rated at ‘IND AA’/Stable), Welspun Enterprises Ltd (Welspun) and PSP Projects (PSP). Kalpataru Projects International Limited (KPIL; debt rated at ‘IND AA’/Stable) and Patel Engineering Limited (Patel; ‘IND A-’/Stable) marginally increased their guidance.

Transrail Lighting Limited (debt rated at ‘IND A+’/Stable; Transrail), Techno Electric and Engineering Company Limited (Techno), KPIL, and Power Mech Projects Limited (Power Mech) reported over 20% yoy revenue growth, while KNR Constructions Limited (KNR; debt rated at ‘IND AA’/Stable), and Ashoka Buildcon Ltd (Ashoka) witnessed a sharp decline in 1QFY26. L&T reported 19% yoy revenue growth, while maintaining guidance of 15% yoy revenue growth in FY26 (FY25: 18.6%).