Serviced Residences Emerging as Mainstream Investment in Indian Real Estate: Colliers

India’s real estate sector is witnessing a major transformation as serviced residences shift from a niche concept to a mainstream investment class. Traditionally concentrated in Tier I cities like Mumbai, Delhi NCR, and Bengaluru, the segment is now drawing increased investor interest driven by global demand for flexible living solutions.

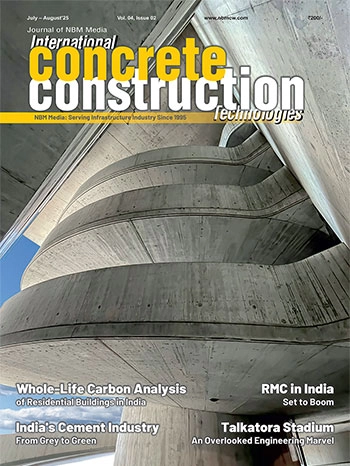

These residences, often in partnership with leading hotel brands, offer the comfort of a home combined with 4–5-star hotel amenities, making them highly attractive to both business and leisure travellers. According to Colliers’ latest report, “Transforming Goa: Unlocking Investment Potential Beyond the Coast”, serviced residences are set to redefine investment trends in the sector.

Tourist Destinations Driving the Next Wave Investments

Beyond Tier I cities, a new wave of serviced residence growth is taking shape in tourism centric destinations. Locations such as Goa, Rishikesh, Kasauli are witnessing heightened demand, fuelled by:

- Rising preference for long-stay and experiential stays.

- The growth of remote and flexible work culture.

- Shifting traveller mindset from regular hotels to branded, professionally managed residences.

- Increasing appeal among second-home buyers seeking rental visibility and ROI alongside lifestyle benefits.

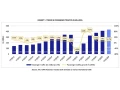

- In Tier I cities, branded serviced residences associated with national or international hotel brands command an average sale price of around INR 22,000 per sq.ft. in Delhi, ~INR19,500 per sq.ft. in Bengaluru, and ~INR 25,000 per sq.ft. in Mumbai. In comparison, tourist destinations offer more attractive entry points, with Goa starting at ~INR11,500 per sq.ft. followed by Kasauli and Rishikesh at ~ INR 9,500 and ~INR 8,500 per sq.ft. Respectively.

Growth Outlook

Goa stands out as, India’s premier leisure and lifestyle destination, with its unique blend of affordability, premium hospitality tie-ups, planned infrastructure projects and strong tourism-driven demand, Goa has gradually undergone a paradigm shift from villa to apartment typology with serviced residences emerging as one of the next major investment trends in India.

As global travellers and domestic buyers increasingly seek lifestyle-driven real estate options, serviced residences in Goa will be ideal combination of price appreciation, consistent rental yields, and long-term lifestyle benefits cementing the state’s place as a preferred destination for investors and homeowners across India and globally. Over the years, Goa’s residential price appreciation of nearly 2.6X from ~INR 4,000 to 10,300 per sq.ft. (2019-2025), Going forward, development is expected to expand from the coast to the hinterland, driven by the operationalization of Mopa International Airport, the planned Phase 3 and 4 expansions, proposed Aerocity and the DMIC corridor. This wave of growth is projected to fuel further price appreciation of 2.5–3.0X by 2032 with rental yield ~8-12%

Serviced residences are transforming into a high-performing asset class, combining investment growth with lifestyle appeal. With rising demand across emerging micro-markets, investors and homeowners have a unique opportunity to unlock long-term good return on investment, capital appreciation while also benefiting from attractive rental yields as second home or holiday home investment,” says Swapnil Anil, Managing Director, Advisory Services, Colliers India.